Bitcoin is on fire, and as it heads into 2025, investors are asking the big question: how high can BTC go this time?

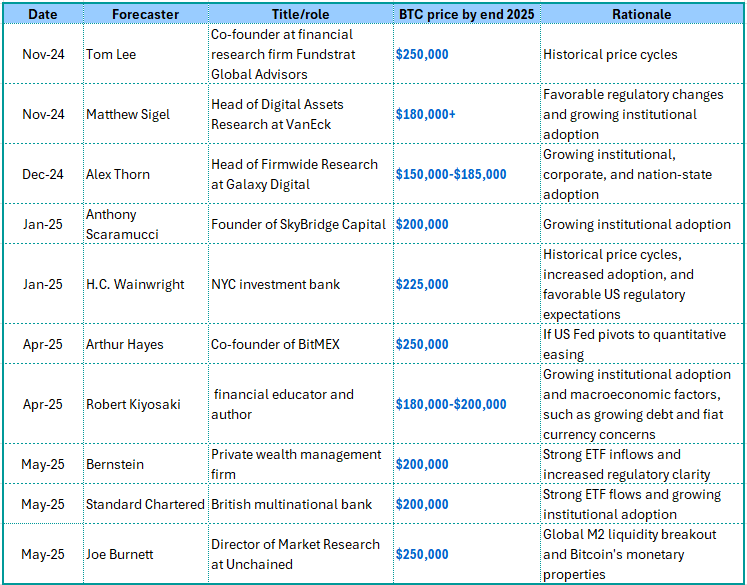

Big-Name Forecasts: $180K–$250K‘

Analysts from VanEck, Fundstrat, and Standard Chartered all forecast Bitcoin topping out somewhere between $180,000 and $250,000 in 2025. Their reasoning?

- Institutional adoption is growing fast.

- Spot Bitcoin ETFs are attracting record inflows.

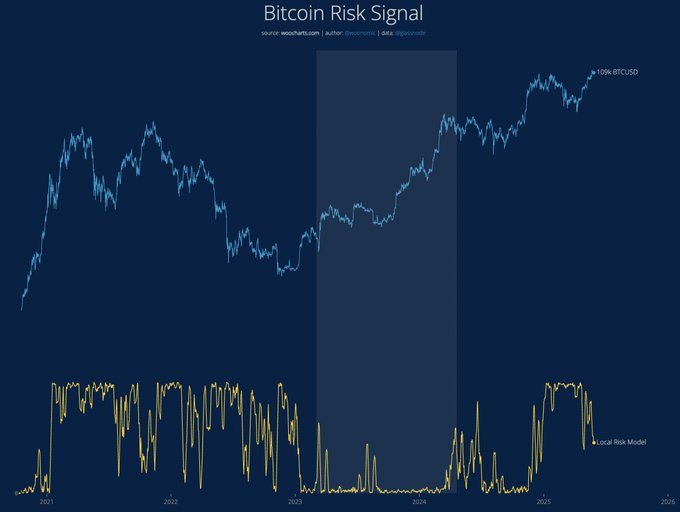

- Market cycles still show bullish momentum.

- And most importantly: global liquidity is rising sharply.

Liquidity Is the New Buzzword

Arthur Hayes put it simply: Bitcoin trades on fiat expectations. And right now, the market expects more money printing, lower real interest rates, and ballooning debt. That’s great fuel for BTC.

Nik Bhatia points out that Bitcoin isn’t just rising on optimism—it’s rising as a safe haven in a fragile macro world.

Should We Worry About 2026?

Some analysts say 2026 could bring a correction—or even a full-blown crypto winter. But not everyone agrees. Willy Woo suggests Bitcoin’s old 4-year cycle may be fading. Instead, Bitcoin might follow global macro trends, not just halving events.

$250K—Too Bullish?

A $250K BTC sounds wild, but remember:

- ARK Invest sees potential for over $500K.

- Joe Burnett believes in a “sovereign race” for BTC, possibly pushing it to $1 million by 2030.

- There’s $7 trillion sitting in U.S. money market funds—ready to move.

Bottom Line

Bitcoin is becoming more than a speculative asset—it’s becoming a global macro asset. If liquidity continues to flow and institutions keep buying, $180K to $250K isn’t just possible—it’s realistic.

FAQs

1. Is Bitcoin really going to hit $250K in 2025?

Possibly. Multiple respected analysts project that range, especially with growing institutional adoption and global liquidity.

2. Should I sell my BTC at $180K or wait longer?

Depends on your goals. Some may secure profits, others may hold long-term, expecting $500K+ in future cycles.

3. Is this bull run different from 2021?

Yes. This time, it’s driven more by institutional buying and ETF inflows, not retail hype.

4. Will 2026 be a crash year for crypto?

Not necessarily. While some predict a correction, others argue Bitcoin’s cycles are evolving with global macro shifts.

5. What makes Bitcoin a good hedge against inflation?

It’s decentralized, finite (21 million BTC), and can’t be printed like fiat money.

Please don’t forget to leave a review.